Candle Open is a precision-built trading strategy for MNQ (Micro Nasdaq Futures) or NQ (Nasdaq Futures) that executes a single trade per day based on the 9:30–9:35 AM ET opening candle. If the candle closes bullish, it goes long. If it closes bearish, it goes short — but shorting is optional and can be disabled with one input, ideal for bullish macro environments.

This isn’t a scalping bot. This is a clean, controlled hit — one trade per day, based on momentum at the most volatile time in the U.S. session. Built for traders who understand the real opportunity is in the opening range — where liquidity, volume, and direction converge.

What Makes It Work:

-

Entry Logic: Trades only once, immediately after the first 5-minute candle with user-defined entry time for any time zone open. Start Hour 9 and Start Minute 30 for Eastern Time.

-

Directional Toggle: Short trades can be turned off completely. If NQ is in a bullish regime, stay long only.

-

Stop Loss / Take Profit: ATR-based. No fixed numbers. The logic breathes with the market. If volatility expands, so does your room to move.

-

No chasing. No signals. No noise.

Who It’s For:

-

Traders who want one clean setup a day with no indicators cluttering the screen.

-

Those who understand that NQ’s best trades happen off the open — and want a system to execute that without hesitation.

-

Strategy developers or algo traders looking for a solid, time-based framework to build on.

Where and When:

-

Designed for Nasdaq. Could work with MES or other instruments but was optimized and tuned specifically for NQ/MNQ behavior.

-

Trades only at the U.S. equity open, where volume and volatility are highest, with user input Start: 9 and Minute: 30 — can be adjusted for other time-based entries (e.g., 4-hour candle change, news events, etc.).

Why It Delivers:

-

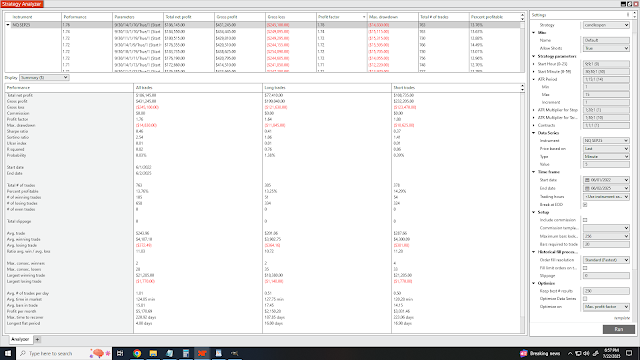

Backtested over 3 years, showing strong results with and without short trades.

-

No Shorts Mode boosts consistency and profit factor in trending markets.

-

Simple ATR logic keeps it adaptable — not rigid.

-

You’re not relying on lagging indicators, repainting signals, or random triggers.

Results (With Backtest Data):

-

Net profit over 3 years: $180k–$220k range depending on settings.

-

Profit factor: 1.60–1.76

-

One trade per day, average trade value $245+

-

Smoother equity curve when shorts are disabled but trades less frequently

One License. No Bloat.

GET CANDLE OPEN

Candle Open Strategy for Ninja Trader 8

Strategy Type: First 5-Minute Candle Reversal Logic

ATR-Based Dynamic SL/TP – Trend-Aware "No Shorts" Toggle

Includes .cs and .txt files + optimized MNQ settings + install PDF

Price: $350Delivery:

Instant download after purchase (ZIP format)

Platform Requirements

- Ninja Trader 8

.png)